TL;DR: When the best creative and technical talent form collectives, they build communities that become powerful moats. Products emerge organically from these groups and grow via essays and demos that demand attention. They can spin out into separate companies, with capital flowing back to fuel the collective. As software becomes cheaper to build and agents more capable, this model introduces a new game where community paired with artistry becomes far more important than capital.

— Daniel

Was this email forwarded to you?

Join curious founders, creators, and investors by subscribing below:

Thesis

A couple of weeks ago I spoke with the managing partner of a venture capital firm about The “Every” Thing blueprint and the new creator fund from

.I talked about how the venture studio model seems poised for a renaissance in the agentic age and he encouraged me to develop a thesis for my own.

My core thesis is a stack:

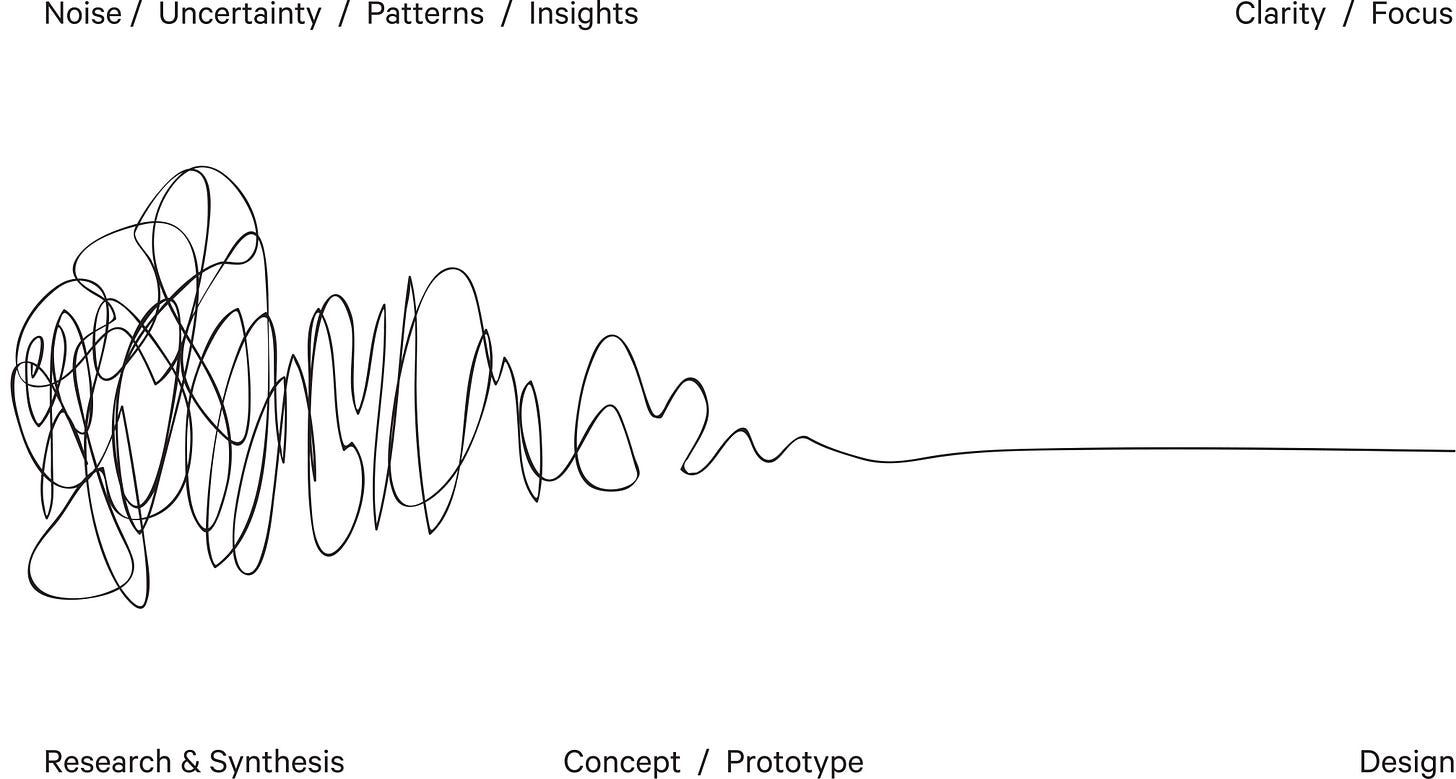

Collective → Community → Products → Capital

Collectives blend creative and technical talent to rapidly test and build ideas.

Communities become the moat—offering organic growth, trust, and feedback.

Products emerge from within, often launched through essays and content first.

Capital follows influence; it becomes most powerful when paired with trust.

Startups have always been laboratories—spaces where people test ideas, fail fast, and pursue concepts that seem crazy until they work. The best founders do things that don’t scale, engage directly with the market, and iterate rapidly.

That won’t change.

But how startups are formed, funded, and grown is undergoing a fundamental shift.

I have a lot of conviction around venture studios in the agentic age because you can take more shots on goal instead of going all in on one idea. Venture studios often raise capital from LPs similar to traditional venture capital firms but it’s now feasible to form a viable studio with far less capital.

When the cost of software development approaches zero, you have to rethink everything. Business models, metrics, burn rates, revenue per employee, etc. Investors have to consider the purpose of pre-seed and seed rounds when tiny teams can go from zero to profitability on their own and get to venture scale by hiring agents instead of leaning on growth capital.

I read an essay from signüll last week about the new power stack and it helped me form the basis of a thesis for a venture studio.

I’m calling this the collective stack.

collective > ecosystem > community > products > companies > capital

The Collective leverages an Ecosystem to build Community and Products. The Community reduces customer acquisition costs and serves as the marketing fuel for new product launches. Successful products can spin off into separate Companies that generate Capital which is returned to the collective.

The short-hand version:

collective > community > products > capital

Collective

The dream of the one-person billion-dollar startup is still alive but more and more creators are realizing it’s far easier to win if you collaborate with others.

What happens when you toss a brilliant entrepreneur, engineer, designer, and writer into a room? You get things like Spiral and Cora.

The members of the collective are the founding members of the community.

Members of the collective serve as both creators and curators, building in public while attracting others who share the vision. The collective model allows for rapid ideation, shared resources, and distributed risk. Each member brings their unique audience and expertise, creating a flywheel effect that accelerates growth.

When successful, these collectives can spin out multiple ventures, each benefiting from the combined network effects and creative capital of the group. The key is finding the right balance of autonomy and collaboration.

Ecosystem

The most powerful ecosystems are YouTube, Twitter, and Substack.

The smartest people on earth are in at least one. Two of my favorite writers,

and , use two quite well.Ecosystems > Platforms.

Bluesky is trying to be a viable ecosystem but it unfortunately is running into headwinds from competing protocols. Most recently the publishing platform Ghost decided to build their social media product on The Social Web instead of AT Protocol.

Ghost<>BlueSky: Because BlueSky is built on a different protocol, it doesn't work the same as everyone else – but, if you follow

@bsky.brid.gy@bsky.brid.gyfrom your Ghost site, you can get your posts showing up there. More info on BridgyFed.

I don’t believe you have to choose only one ecosystem and it’s becoming increasingly easy to manage several. It could be an advantage to have different members of a collective leverage the ecosystem that they’re active in and understand intimately.

Community

Followers and newsletter subscribers alone won’t be good enough.

Community is the metric that truly matters.

Show me your subscriber count and I’ll ask for your engagement rate.

Community will be one of the last moats standing in the creator economy.

A strong community provides organic distribution, rapid feedback loops, and built-in product-market fit validation. They act as both early adopters and evangelists, spreading the word through genuine enthusiasm instead of paid advertising.

The key is fostering authentic connections between members.

This creates a self-sustaining ecosystem where value flows naturally between creators, community members, and the broader market.

The future belongs to creators who understand this dynamic.

Products

An essay should be the first product.

Every spent years building trust by creating brilliant content.

I do believe that software is now a form of content but the focus should be on writing and community building first and foremost.

Engineering as Marketing is a viable tactic to grow an audience but it shouldn’t come at the expense of great writing and storytelling.

A mix of code & prose, one informing the other, is probably the answer here.

Companies

Products can be spun out into separate entities and can run independently of the collective. The collective, at this stage, would serve as an investor.

Collectives can build and scale multiple companies because reaching venture scale does not require late-stage venture dollars anymore.

Each successful company strengthens the collective's brand, attracting more talented creators and expanding the community's reach. The flywheel effect accelerates as the collective's track record grows, making it easier to launch and scale subsequent ventures.

Capital

Having a ton of money is no longer an advantage. Products are cheap to build and capital is becoming more of a commodity if there’s no influence behind it.

But capital paired with influence and community?

That’s a moat.

Influence amplifies capital's impact and creates opportunities that money alone can't buy. When collectives combine capital with the trust and attention of a thriving community, they unlock unprecedented leverage.

— Daniel

I appreciate your feedback. If you enjoyed this piece, drop a like or comment below. You can also send a note to daniel@hunter.vc, would love to hear from you.